In today’s competitive world, pursuing higher education has become increasingly expensive. Many students face financial challenges when it comes to funding their education, whether it’s for studying in India or abroad. Vidya Lakshmi Education Loan, launched by the Government of India, aims to provide financial assistance to students who wish to pursue their dreams without worrying about the financial burden.

In this guide, we will walk you through the complete process of how to apply for the Vidya Lakshmi Education Loan, the benefits it offers, eligibility criteria, and how you can make your application successful in 2024.

What is Vidya Lakshmi Education Loan?

Vidya Lakshmi Education Loan Scheme is an online portal launched by the Ministry of Finance, Government of India, to provide financial assistance to students seeking loans for higher education. The portal connects students with various nationalized, private, and foreign banks, allowing them to apply for an education loan directly from the comfort of their home.

This initiative not only simplifies the process but also brings transparency in terms of interest rates, loan limits, and terms, making it easier for students to compare and apply for the most suitable loan offer.

| Also read :- |

Benefits of Vidya Lakshmi Education Loan

- Easy Online Application:

One of the biggest advantages of the Vidya Lakshmi portal is the online application process. Students can directly apply for an education loan from multiple banks through a single platform, saving time and effort. - Loan Amount:

- For studies in India: Up to ₹10 Lakhs

- For studies abroad: Up to ₹40 Lakhs

This amount can cover tuition fees, travel, hostel expenses, and other academic-related costs.

- Low Interest Rates:

Vidya Lakshmi offers competitive interest rates for education loans, typically ranging from 9% to 12%, depending on the bank and the loan amount. Additionally, some banks provide subsidies on interest for economically weaker sections or merit-based students. - No Collateral for Loans up to ₹7.5 Lakhs:

For loans up to ₹7.5 lakhs, there is no need for collateral, making it easier for students from middle-class families to apply for the loan. - Flexible Repayment Options:

Vidya Lakshmi offers flexible repayment terms that allow students to start repaying the loan after completing their studies or securing employment. Many banks also provide a moratorium period (usually 6 months to 1 year) before repayment begins.

How to Apply for Vidya Lakshmi Education Loan in 2024?

Applying for a Vidya Lakshmi Education Loan is simple and hassle-free. Follow the steps below to start your loan application process:

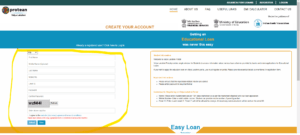

Step 1: Visit the Vidya Lakshmi Portal

Go to the official Vidya Lakshmi portal: www.vidyalakshmi.co.in. Create an account by registering with your email ID and basic personal details.

Step 2: Fill in Your Loan Application

Once logged in, fill out the loan application form. You will be asked for details such as:

- Your personal information (name, address, phone number)

- Academic details (course, university, and course duration)

- Loan amount required

- Details of the course (domestic or international)

Step 3: Upload Required Documents

After filling out the application, upload the necessary documents:

- Proof of identity (Aadhaar card, passport, etc.)

- Proof of address

- Admission letter from the institution

- Academic certificates (10th, 12th, graduation, etc.)

- Income proof of parents/guarantors

Step 4: Choose Your Bank

Once your application is complete, the portal will provide you with a list of banks offering education loans. You can select the bank that offers the best interest rates and loan terms according to your needs.

Step 5: Submit the Application

Submit your application through the portal, and wait for the banks to process your request. Banks will evaluate your application and documents. Once your loan is approved, you will receive the funds as per the bank’s disbursal process.

| Vidya Lakshmi portal application form | |

| Who is eligible for Vidya Lakshmi education loan? | Every student who want to read. |

| What is the maximum amount of Vidya Lakshmi scheme? | 10 lakh |

| Bank list for student loan | |

| State Bank of India | IDBI Bank |

| Bank of India | Bank of Baroda |

| Central Bank of India | Canara Bank |

| Axis Bank | Bank of Maharashtra |

| HDFC Bank | ICICI Bank |

| Important Link | |

| Register Now | Click here |

| Already Log in | Click here |

| Join My Whatapp Group | Click here |

Eligibility Criteria for Vidya Lakshmi Education Loan

To be eligible for the Vidya Lakshmi Education Loan, students must meet the following criteria:

- Indian citizen: Only Indian citizens can apply.

- Enrolled in a recognized institution: The student must be admitted to a recognized educational institution in India or abroad.

- Age limit: The applicant must be between 18 to 35 years of age.

- Academic performance: Most banks require students to have a minimum percentage of marks in their last qualifying examination (usually 50% or higher).

Common Documents Required for Vidya Lakshmi Education Loan

- Proof of Identity: Aadhaar card, passport, voter ID, or any other government-issued ID.

- Proof of Address: Recent utility bill, passport, bank statement, etc.

- Admission Letter: Letter or proof of admission from the university or college.

- Academic Transcripts: Class 10, 12, and graduation certificates and mark sheets.

- Income Proof: Income certificate or salary slip of the parent/guardian.

- Collateral (if applicable): For loans above ₹7.5 lakhs, some form of collateral may be required.

Vidya Lakshmi Education Loan – Repayment Process

Repaying your Loan is a straightforward process. You will begin repayment after the moratorium period, which typically starts after the completion of your studies or after you secure a job.

- Flexible EMI options: Most banks allow students to choose monthly installments (EMIs) based on their income.

- Online payments: Banks also offer online facilities to make repayments easier.

Education Loan – FAQ

1. What is the maximum loan amount I can get under Vidya Lakshmi?

You can get up to ₹10 Lakhs for studies in India and ₹40 Lakhs for studies abroad.

2. Do I need a guarantor for the loan?

For loans up to ₹7.5 Lakhs, no guarantor is required. For loans above ₹7.5 Lakhs, a guarantor or collateral may be necessary.

3. How long does it take to get the loan approved?

Once you submit your application, the loan approval process typically takes around 10-15 business days.

4. Can I apply for Vidya Lakshmi Education Loan if I am planning to study abroad?

Yes, you can apply for a loan under the Vidya Lakshmi portal for both domestic and international studies.

Conclusion:

The Vidya Lakshmi Education Loan is an excellent opportunity for Indian students to fund their higher education. With competitive interest rates, flexible repayment options, and a simplified online application process, this scheme aims to reduce the financial barriers that many students face. If you’re planning to pursue higher education in India or abroad, make sure to apply for the Vidya Lakshmi Education Loan and take the first step toward realizing your academic dreams.